Silver And Gold

why you need it, right now

As a prepper, you’ll find me occasionally writing on topics that relate to prepping. If you’re not familiar with ‘prepping’, in short, it is preparing for various scenarios, whether it be the Alien Ant Invasion, Thermonuclear Warfare, an EMP, an aggravated recession, or something else.

(those are all clickable links leading to articles/stories I’ve written, check ‘em out!)

Often, preppers will prepare for these hypothetical scenarios in a variety of ways, from self-defense tools, food storage, energy production, and holding on to “stores of value”.

If you’re familiar with cryptocurrency, I’m sure you’ve heard the term “store of value” before in reference to Bitcoin. But I’ll save the topic of crypto for another post, because I have a lot to say about that, as well.

This article is reserved for these two precious and beautiful metals

Tell the truth. Your eye is automatically attracted to the image above. You probably stared at that image for a couple of seconds, at least, admiring the sheen and shine of these two metals.

If you didn’t, you might not be human. Consult your local doctor immediately. Something is wrong with you. Every human on the planet, including babies, is attracted to these precious metals. Why is that?

I honestly don’t have an answer for you. Some people suspect aliens genetically manipulated us to be slave miners and implanted gold-loving genes into our chromosomes. I’m not so sure about that, but I can tell you it’s an undeniable and inescapable truth that no matter where you were born, whether in Boston or Bangladesh- it’s universal.

Enjoy some classic music as you read:

From a prepper standpoint- there are a variety of things you can stash and store. Food, ammo, liquor, energy, etc. Goods that have actual uses. But what uses do silver and gold have? Quite a few, actually.

Silver is used in jewelry (obviously, but it has applications in electronics (high conductivity), medical applications (antibacterial properties), solar panels, and mirrors and coatings (very high reflectivity).

Gold has slightly different properties, but can be used in all of the applications listed above, as well.

But in a post-apocalyptic world, and assuming total collapse of industry, what good would silver and gold be? Some would say, “You can’t eat it”. That is true, but if I have a large store of food… what can you offer me in return?

Let’s imagine a bartering scenario between two guys, John and Steve.

STEVE: “Hey John, got any more cans of tuna left?”

JOHN: “I sure do, Steve! Whaddaya have?”

STEVE: “I’ve got some old greenbacks from the fiat currency days, some USB sticks, and a bunch of aluminum cans.”

JOHN: “Sorry, Steve, I’m all stocked up on aluminum. Do you have any silver, gold, or ammo?”

STEVE: “No, John, I’m fresh out of ammo too, Billy used up the last of it hunting a squirrel. Fucking idiot.”

JOHN: “Shucks, Steve, that’s not good. Well, I’m sorry, but I can’t help you.”

It’s really about that simple. Fiat currency will obviously be worthless in such a scenario, as it will not be backed by any government, or will be inflated to all hell. Food, water, ammo, and silver and gold will be the name of the game.

Food is capable of spoiling. Very essential, but not very efficient.

There are lots of arguments to be made for BRASS (ammo) being an extremely effective and efficient “store of value”. Also plenty of arguments for Liquor, Coffee, or Tobacco products as well. But these items aren’t the focus of this post.

You can forget about cryptocurrency, assuming power lines are destroyed or the grid goes down, so you’re pretty much left with the oldest stores of value on the planet that are universally and historically respected by every single human, across the globe.

^ Look at this wonderful and ancient eye candy. Beautiful, isn’t it?

A single silver coin in a bartering situation could mean a week’s worth of food. A single gold coin could be a year’s supply of Jack Daniels, to drown out the blues. You see, these are extremely dense and efficient stores of value.

Here are some more interesting facts about Silver (Ag):

We already stated that it has high reflectivity, but what we failed to elaborate on is that it actually has the highest reflectivity of any other metal. It also has the highest conductivity of any other metal. It quite literally is the best in category in these two areas. Not particularly useful in the post-apoc, unless you’re an electrical engineer or mirror-maker, but still - pretty cool.

Here are some more interesting facts about Gold (Au):

Gold is edible. Not very nutritious, but edible nonetheless. It is also the most flexible and ductile metal that I’m aware of, hence “gold leaf” and gold plating. A single ounce (a coin about the size of a Kennedy Half-Dollar) can be hammered into a sheet 300 square feet. It is very unique amongst the metals, specifically its unique color, whereas most metals are dull and gray, or silverish at best.

So what’s the point of this post? I honestly shouldn’t be telling you guys to invest it in, because higher demand will lead to lower supply, which will lead to higher prices, which will affect my own acquisition. But, I’m not that selfish of a person - so yes, I am advising you to acquire and store these metals in the event of a currency, government, or global collapse of any kind.

If you’re looking to get started, I have a couple of recommendations (for those in the United States, at least)

SDBULLION: best prices I’ve been able to find for bullion.

APMEX: if you’re looking for variety, flavor, and artistic pieces.

There are plenty of others that I could list, but I’m not here to shill for these companies. They charge enough on the cut, as it is, and they’re not paying me - so go find whatever works for you.

I always recommend .999 Silver (pure) and .999 Gold (pure) bullion. There’s no reason to skimp on this, in a bartering situation, you don’t want the purity of your product to be questioned. There are some people who recommend “Junk Silver” -

- but I’m not one of them. These are typically any US Coin produced before 1964, and there are different types: 90%, 45%, and 35%. That’s exactly the reason I wouldn’t recommend them, because, in a bartering situation, I don’t want to have to run calculations through my head trying to figure out what to charge you for my bottle of Jack Daniels, or whatever it is you trying to buy from my post-apocalyptic storefront. I’ll still trade with you, but a customer with pure metal is going to get priority and preference, every time.

Like I said, better than nothing, but not my first recommendation. Go for pure, in my opinion.

So… bars or rounds (coins)? It really doesn’t matter, because in a bartering situation, I would take either. But rounds (coins) do have a slight edge here, because of their historical usage. They jingle in your pocket, they have faces. They’re cool. They’re just slightly less economical from an investing perspective, retailers usually charge more, because the production process is more intensive rather than just smelting down a bar.

So… what kind of round then? There are two types. Those that come from companies like SDBullion and Apmex, and those produced by government mints. In a bartering situation, once again, I will trade with you either way, but the government mints will have a premium/priority.

Here is an example of a standard round produced by private mints:

They have all kinds of these, with all kinds of faces, all kinds of designs, and you can find some really cool ones that have flavor and are cool to just finger and look at.

Now here’s an example of a government-mint-issued coin, the “gold standard” of coins, the American Eagle.

(there is an eagle on the back of the coin, hence the name)

At the time of this writing, these go for about $37. The US mint charges a premium on their coins compared to other mints such as the Royal Mint (UK) or the Canadian Mint. So, fuck the US Mint, and fuck the American Eagle. In a bartering situation, I will NOT place priority on an American Eagle over any other government mint coin. Those who invest in these are foolish, in my opinion.

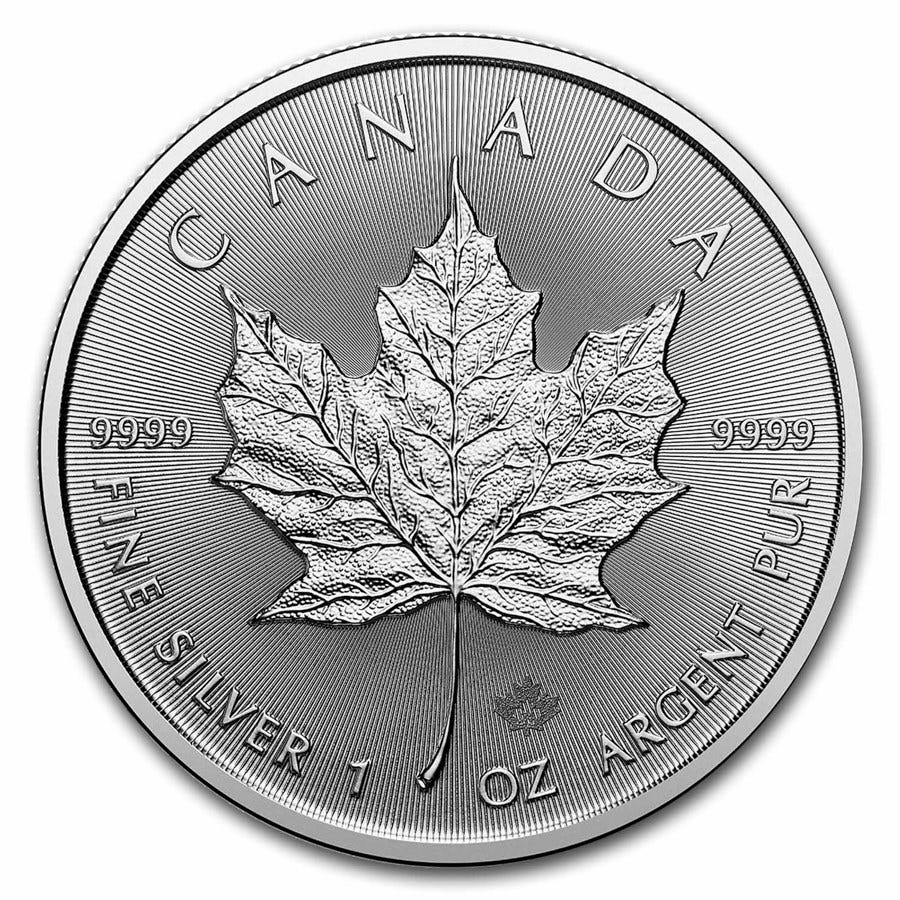

So… what would you recommend then? I like the Canadian Maple Leaf, which has some high-tech built into it to prevent fraud.

(note the leaf’s relief and the little etchings in the background, they also create an optical illusion or ‘pulsating’ effect when twisted around)

The latest editions of the Canadian Maple Leafs (not Leaves) are extremely beautiful and are going for around $34, at the time of this writing. A few bucks less than the dreaded US Mint product.

But my absolute personal favorite is the Royal Mint’s Brittanias.

These are obviously beautiful and come with security features and only run you about $32 at the time of this writing. You really can’t beat them. The Royal Mint makes the best product for the fairest price, in my opinion.

But these are all really aesthetic preferences, really. At the end of the day, .999 Silver is still .999 Silver no matter where it comes from, and whether it has a cool design or not. In a fair bartering situation, you should get an equal trade no matter the coin, whether it is mint, or round - as long as it is genuine. It just helps that these coins have “security features” that help you immediately recognize them as the real deal without any doubt or suspicion. Generic rounds may be held up to closer scrutiny.

As for gold, gold coins are basically the exact same. Just a different metal.

With gold, the premiums aren’t as big as a deal. A few bucks here and there don’t mean much when you’re dropping ~$2600 on an ounce. In this case, you could go with the American Eagle, if you wish.

So that leads to the next question, should I invest in Silver… or Gold?

The answer is both! Let’s say I want to buy a semi-automatic rifle (AR-15) from you. I can bring an entire sack of Silver coins, weighing a few pounds, or I can bring a single Gold coin. It’s all about efficiency. Gold is obviously the more efficient “store of value.” It also doesn’t tarnish the same way Silver does, hence the term “Gold Standard.” Tarnishing is an unfortunate side effect of Silver, but can be prevented through careful storage. In a bartering situation, the aesthetics won’t matter that much, I’m looking for .999 for the most part.

My advice to you, if you’re new or considering investing in physical gold and silver is to diversify. Get gold and silver bars, rounds, coins, generic and government, and of different weights (grams, ounces, half ounces, etc). You never know what your bartering situation might call for. If you only stack 1 oz Gold coins, that’s going to be an expensive can of tuna, my friend. Likewise, if you only stack silver, you’re going to be carrying around a lot of weight, and there will be lots of jingling in your pockets, and you might get robbed.

Note that I only advise investing in physical Gold and Silver. There are ETFs and whatnot, that you can invest in through Robinhood, but that’s if you’re trying to hedge bets or make profits through trades. And who can say what will happen to these markets in a collapse scenario? You might not be able to “cash out”. Better to have the real thing within arm’s reach. Your gold certificate or piece of paper saying you own X amount of Ag/AU in Y ETF will mean absolutely nothing to me in a bartering situation. No cans of tuna for you, my friend.

And what about other metals? Platinum and Palladium are precious, right? Yes, they are, but you can forget about it. They don’t hold the same historical significance as Gold or Silver, and they pretty much look just like Silver anyway. It’s unlikely that I will have a Palladium testing kit at my bartering post. Forget about it.

If you’re worried about price fluctuation on these metals, or the value dropping, you probably aren’t paying attention to what’s going on in the world lately. The prices are skyrocketing because of global insecurity. When the shit hits the fan, economies collapse, governments go bankrupt, and currencies inflate - humanity goes back to the basics, every single time. It is your best bet and hedge against economic insecurity.

Just last year you could pick up a generic silver round for about $18. Now they’re nearly $30. Do the math.

It’s not too late to jump in the game. I assure you, the prices of these will only keep rising. If the world settles down and there is peace and harmony for all of mankind, or the US settles its debt crisis, perhaps you can ignore Silver and Gold. But that’s highly unlikely. The shit that’s hitting the fan will only continue to accelerate, by every available indicator. Get in before it’s too late. Buy into the FOMO (fear of missing out) that I’m selling you, because it’s for your own good (not mine).

That is all.